Jute, the golden fiber of Bangladesh, has a golden history. It used to be the first product which introduced ‘Bengal’ in the international market with its quality. It had brought about the 2nd industrialization after Moslin in Present Bangladesh. It was the single largest industry in East Bengal under British rule. Jute was supplied as raw material for wide variety of industries in Europe and America. Still it plays a fundamental rule in the economy of Bangladesh. In order to graduate as a middle-income country with the aim of accomplishing 8% GDP growth rate, Jute can be the new growth driver of Bangladesh economy.

Jute in ancient times

The use of jute in ancient times can be found from historical documents. At the time of Mughal Emperor Akbar, people wore clothes made of jute beside Moslin. There were some other uses of jute like jute rope, macramé hanger and thread etc. Chinese used jute to make paper from very antique time.

From 17th century

Jute entered into the international market during 18th century with the benefit from political unrest. Russia stopped their supply of flax & hemp as consequence of Napoleonic War (1822) & Crimean War (1853) which was raw materials of spinning mills in Scotland. On that time, America also stopped supply of cotton which was close and cheap substitute of flax & hemp. British East India Company’, the monopoly ruler and as trader in the subcontinent, took this opportunity and exported 100 ton of jute for the first time to Dundee. Between 1870 and 1890, the number of spindles rose from 94,520 to 26,81,654 and the number of looms from 14,911 to 43,361.

Jute industries in Bengal

Jute was comparatively cheaper and labor in Bangladesh was also cheap on that time, so many family from Dundee came to Bangladesh to set their new business wings. Mr. George Auckland (a coffee planter of ceylon) was the pioneer and opened the first jute mill named ‘Wellington Jute Mills’ in Calcutta in 1855.

By the beginning of twentieth century jute manufacturing had clearly become the foremost industry in Bengal and had begun to compete with Dundee for domination in the world market. The outbreak of the First World War led to rapid increase in demand for raw jute, since it was used to manufacture sand bags to protect solders in trenches and to carry food grains for army. It played an even stronger role in the post Second World War recovery and growth with traditional end-uses such as sacking, hessian and carpet backing requiring larger volumes.

After the partition of 1947

After British rule in India during 1947, most of the Jute mills started to evolve in the center of India. And this industry was led by Marwaris businessmen. In East Pakistan after partition in 1947 lacked a Jute Industry but had the finest jute fiber stock. As the tension started to rise between Pakistan and India, the Pakistani felt the need to setup their own Jute Industry. Several group of Pakistani families (mainly from West Pakistan) came into the jute business by setting up several jute mills in Narayanganj of then East Pakistan, the most significant ones are: Adamjees, Bawanis, Ispahanis and Dauds.

After liberation of Bangladesh in 1971

After the liberation of Bangladesh from Pakistan in 1971, most of the Pakistani owned Jute Mills were taken over by the government of Bangladesh. Later, to control these Jute mils in Bangladesh, the government built up Bangladesh Jute Mills Corporation (BJMC).

Current market conditions

“The Jute industry is losing productivity and competitiveness due to its old technology, creating risks of survival of the sector and employment loss.” -Leaders of the Jute and Jute Industry Protection Committee.

If the public sector jute mills are shut down, 35,000 workers will become jobless. So far, the country witnessed a shutdown of 51 jute mills. The world market is still in favour of Bangladeshi jute and jute goods, although the public sector mills have been facing difficulties. Currently the mills are operating with the old machines which have a 66% productivity rate. To tackle the situation the sector needs new technologies.

ActionAid Program Director Asger Ali Sabri said a packaging act should be effectively imposed to encourage jute-made bags and packaging in the local economy. Importance of diversifying our jute products to run the mills and creating new market is paramount. Other issues like administrative bottlenecks, lack of accountability and corruption need to be addressed.

Decline to Jute Trade in competition to Synthetics

It was hard to meet the huge demand for raw jute and jute after 1960, demand. So, the demanders searched for alternate and found Nylon & Polythene. As the use of polythene and other synthetic materials as a substitute for jute increasingly captured the market, the jute industry in general experienced a decline. During some years in the 1980s, farmers in Bangladesh burnt their jute crops when an adequate price could not be obtained. Many jute exporters diversified away from jute to other commodities. Jute-related organizations and government bodies were also forced to close, change or downsize. The long decline in demand forced the largest jute mill in the world (Adamjee Jute Mills) to close in Bangladesh. Bangladesh’s second largest mill, Latif Bawany Jute Mills, formerly owned by businessman, Yahya Bawany, was nationalized by the government. Farmers in Bangladesh have not completely ceased growing jute, however, mainly due to demand in the internal market. Between 2004–2010, the jute market recovered and the price of raw jute increased more than 500%. Jute has entered many diverse sectors of industry, where natural fibers are gradually becoming better substitutes.

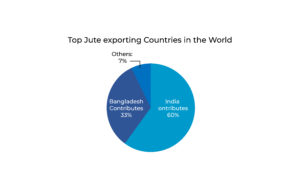

Market Share

Bangladesh is currently producing 33% of the total jute in the world. The position of Bangladesh in jute production is 2nd in the world after India. India produces almost 60% of total Jute. The other major producers are China, Uzbekistan, Nepal, South Sudan, Zimbabwe, Egypt, Brazil and Vietnam. There is huge potentiality in jute production in Bangladesh as the soil and climate of Bangladesh are favorable for it. We can also save our 30 Mn acres of forest by using jute instead of wood in paper industry.

Export

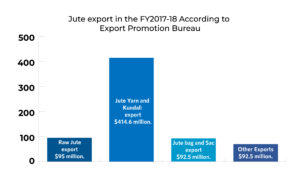

Jute and jute goods export maintained a steady growth as the country earned $66.18 crore in the first seven months (July-January) of the current fiscal year (FY2017-18),

which is 17.36% up from the previous fiscal (FY2016-17).The country earned $563.9 Mn by exporting jute and jute goods during the same period in FY2016-17. According to the Export Promotion Bureau (EPB), earnings from raw jute export were $95.5 Mn during July-January period of FY2017-18, from jute yarn and kundali were $414.6 Mn, from jute sac and bag were $92.5 Mn and from other jute products were $70.3 Mn. Cash incentive has been increased to 20% for export-oriented diversified jute products. As a result, export of diversified quality jute products has increased several times. The use of modern technology and extensive research in the jute industry to further increase exports. Bangladesh earned $962.42 Mn from jute exports in the 2016-17 fiscal year, as compared to $918 Mn in FY2015-16.

Moreover, the world market for jute bags will reach $2.6 Bn in 2022, and Bangladesh can use this opportunity. Bangladesh now exports jute and jute goods worth $1 Bn, but this could be raised to $5-7 Bn with proper policy guidelines. About 40 Mn people in Bangladesh are directly or indirectly involved in the jute sector.

Factory

There are 251 jute mills in Bangladesh according to Bangladesh Jute Spinner Associations. Most of the Jute mills are under BJMA. There are three zones in BJMA. They are -Dhaka, Chittagong, Khulna etc. But the problem in our jute mills is the antiqued machineries which were installed during the 1950s and for their presence the productivity has fallen by about 40% every year.

To get a large growth in this sector and to save this industry, we are in need of modernizing the mills. There was a contract between Bangladesh and China in 2014 to improve productivity of 25 jute mills yet we are not reaping the fruits of it. According to industry analyst only 5,000 crore would be enough to modernize all jute mills under Bangladesh Jute Mills Corporation and clear the arrears and retirement benefit.

Division wise Production

31.75 % jute was only produced in Dhaka in FY 2016-17. The 2nd best producers in terms of division is Khulna and it has 31.16 % jute production from total production in FY 2016-17. Kushtia as a district produced most of the jute in Bangladesh and it produced 5.75% of total jute production in Bangladesh.

Price

Jute fibre is produced mainly from three commercially important species, namely White Jute (Corchours capsularis), Tossa Jute (Corchorus olitorius) and Meshta. Currently Bangladesh produces 240 types of jute products as compared to 135 last year.

Farmers are forced to sell jute to the middle men at BDT 1500 per 40 KG. But the middlemen sell it to BJMC for BDT 2600 or more. The selling price of BDT 1500 does not cover production cost of the farmers. Every year the cost of jute production is increasing but the selling price is declining. The following data is taken from BJA on Jute price at 13 December, 2017.

The demand for jute sacks will rise as there is a law which was enforced on 2014 to pack all commodities in jute made bag.

Challenges

Raw jute exporting is a source of revenue for a long time. But, raw jute export was stopped in 1984, 2009 and 2015. Moreover, the export was hampered highly in 2013-2014 due to political unrest. For the presence of these occasions, raw jute exporters faced huge loss. So many of them quit their business in jute. There is another challenge with low quality jute in our jute sector. Without being able to export the low-quality jute, the local market price of all categories of jute would fall. There will be a huge stock of lower quality jute, and farmers will stop producing jute. Every year in Bangladesh estimated 700,000-800,000 bales of raw jute are produced in.

Of them, 400,000-450,000 bales of jute are used in local mills. So, there should be a well- managed exporting system in our country. 2018 is a political year and so it will be challenging one for jute sector in Bangladesh. India accounted for 15 % of Bangladesh’s total export receipts of $741 Mn from jute and jute goods in the first eight months of the fiscal year, according to EPB data. But recently exports of jute products have declined after India imposed ADD on jute products from Bangladesh.

Global car industry needs about 100,000 tonnes of jute in each year. Bangladesh has the potential to become the main supplier of jute to the global car industry. Of the amount, 12,000 tonnes come from Bangladesh. Bangladesh supplies jute to car brands like BMW, Mercedes-Benz, Toyota, Renault, Mitsubishi, Volvo, Audi, Daimler Chrysler and Ford. Moreover, a Bangladeshi scientist named Dr. Mubarak Ahmad Khan has synthesized a polymer from jute fiber to create a kind of bag like a polythene bag but without the adverse environmental effect. It is more durable and can support more weight than normal polythene bags. The main challenge for jute polymer will be the cost which is 1.5 times higher than polythene bags though the cost can be reduced by scaling up production. So undoubtedly it can be said that Bangladeshi jute brand will bring new avenues in world market with the demand of being environmental sustainable. The growth in supply has remained stagnant at 5 % for many years. So, Bangladesh has the enormous potential to export jute and jute goods.

Jute is a natural biodegradable fiber with the advantages such as high tensile strength, excellent thermal conductivity, coolness, ventilation function. Recently, due to the improvement of people’s awareness on environmental sustainability, the demand of natural biodegradable and eco-friendly fibers is rising worldwide day by day. Bangladesh has the potential to export jute and jute goods worth $5 Bn to $7 Bn annually in the next seven years.